SAIL THE SEVEN SEAS

TIM is a collaborative, multi level family office and service delivery platform

GET CONNECTED

to a service provider

TIM can connect you with 70m wealthy clients and 1m financial service providers – worldwide.

Connect your core competencies with those of your partners of choice. Manage your company using the TIM platform, delivering tailored services and increasing client data security.

GET REGISTERED

become a service provider

TIM enables you as a local expert to offer your competencies globally thereby expanding your service reach beyond your own market.

Get listed on the global service provider map.

Get listed on the global service provider map.

GET STARTED

setup TIM platform

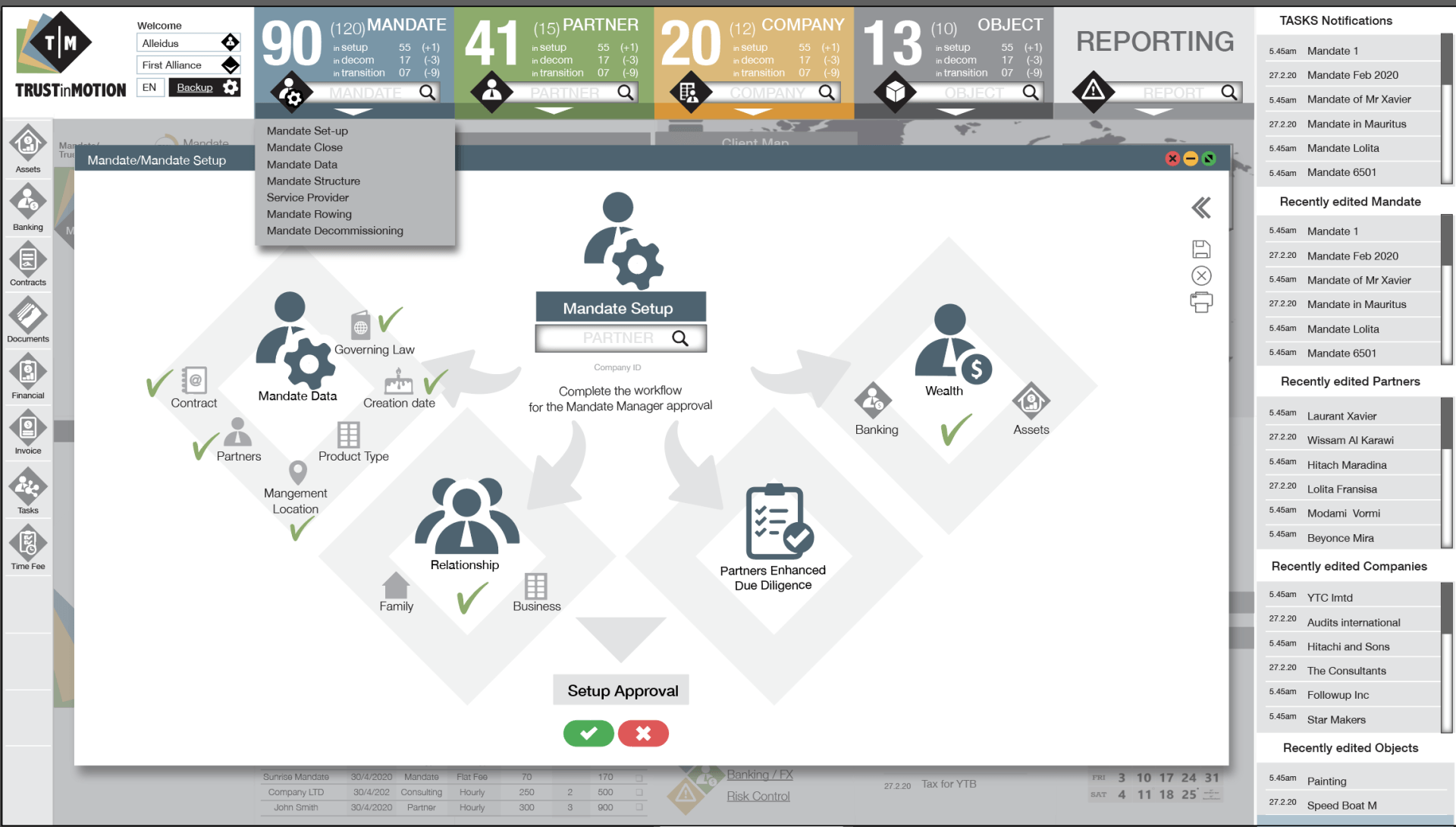

Customize your products and services based on predefined processes functions and features.

Setup your clients and leads, define your financial and fiduciary mandates and connect clients with service providers.

Setup your clients and leads, define your financial and fiduciary mandates and connect clients with service providers.

Do You Need a Collaborative Platform?

Play the Video to find out

Visual & Easy

Bildtitel

Untertitel hier einfügenButton

Bildtitel

Untertitel hier einfügenButton

Bildtitel

Untertitel hier einfügenButton

EASY VISUAL SECTIONS

Check and work on the information you need

Who uses TIM

Who uses TIM

You are a:

- Financial Planner

- Legal Expert

- Tax Professional

- Notary

- Investment Advisor

- Wealth Manager

- Family Office

- Charity & Philanthropy Specialist

Schaltfläche

Unique Productive Experience

Have a quick look on this video demo to check how the platform works!

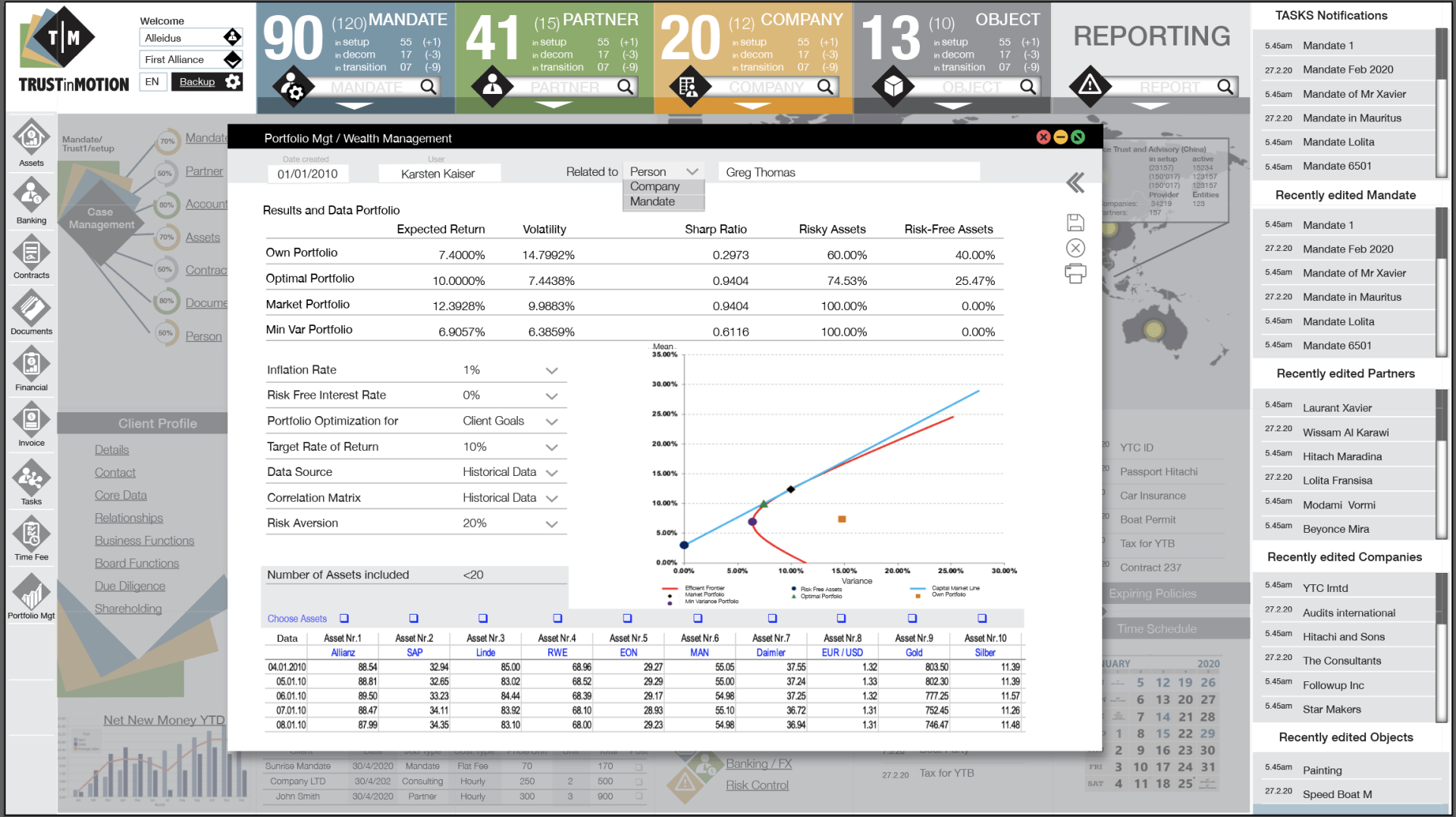

A combination of:

Partner/ Company/ Object/ Mandate,

with a variety of tools that allows to perform

your work in an infinite workflow procedures...

Just the way you want it to be!

Why is TIM for you

Why is TIM for you

You Offer Products like:

- Trust, Foundation, Life

- Manage Companies

- Structured Finance / Loan

- Wealth Advisory / Planning

- Global Wealth Consolidation

- Museum & Gallery

Schaltfläche

You are:

- A Financial Planner

- A Legal Expert

- A Tax Professional

- A Notary

- An Investment Advisor

- A Wealth Manager

- A Family Office

- A Philanthropy Specialist

Schaltfläche

You Can Manage:

- Clients & Companies

- Partners & Mandates

- Art & any other Objects

- Documents & Contracts

- Fees, Posts & Invoices

- Accounts

- KYC / CLM

- Enhanced Due Diligence

- Risk & Compliance

- Financial Profiles

- Assets & Wealth

Schaltfläche

Kontaktieren Sie uns

Vielen Dank, dass Sie sich an uns gewendet haben.

Wir setzen uns so schnell wie möglich mit Ihnen in Verbindung.

Wir setzen uns so schnell wie möglich mit Ihnen in Verbindung.

Tut uns leid. Beim Senden Ihrer Nachricht ist ein Fehler aufgetreten.

Bitte versuchen Sie es später noch einmal.

Bitte versuchen Sie es später noch einmal.